Nigerians have been stunned and bewildered after colossal heaps of cash have been uncovered out different parts of the nation lately. We will demonstrate to you what is happening truly.

In February, $9.2m and £750,000 were found by Nigeria’s hostile to debasement office, the EFCC, in a property having a place with Andrew Yakubu, a previous chief of the national oil organization, NNPC.

In March, substantial sacks containing packs of “firm” banknotes worth a sum of $155,000 (£130,000) were found in Kaduna air terminal.

In April, a reserve containing $43.4m, £27,800 and 23.2m naira were recouped from a Lagos flat with its proprietor yet to be recognized.

Furthermore, these are recently the tip of the chunk of ice.

Whistle blowers compensated

EFCC head Ibrahim Magu was cited in the neighbourhood media as saying that the aggregate sum recouped by the organization in the previous couple of months was about $53m, £120m and €547m, on top of countless Nigerian naira.

He attributed this to the shriek blower approach set up by the legislature in December 2016.

An especially succulent sentence emerges from the five-page strategy archive made accessible on the service of fund site:

“A whistle blower in charge of giving the administration data that straightforwardly prompts the deliberate return of stolen or covered assets or resources might be qualified for anyplace between 2.5-5% of sum recouped.”

There is an extraordinary page for submitting tip-offs.

Inside three months Finance Minister Kemi Adeosun unveiled that they had gotten 2,351 tips, sent in through telephone calls, instant messages and emails.

Actually, the strategy likewise guarantees to secure the character of all whistle blowers.

Such colossal wholes of money as those found couldn’t have strolled into the homes all alone.

The normal Nigerian rich man or lady, incapacitated to physical work, would have needed to enrol the administrations of their more distant family, followers or holders on, to transport the money.

Cashless approach

Previously, whistle blowers or not, it might have been hard to locate any a lot of trade lying around out Nigeria.

The supplies would have been chilling in banks, or on the way to different remote goals.

Be that as it may, in 2012, the Central Bank of Nigeria (CBN), under Lamido Sanusi, now the Emir of Kano, presented a “cashless approach”.

This put restricts on the measure of money based exchanges, empowering electronic exchanges.

As the CBN notes in the “Cashless Nigeria” area of its site: “High money utilization empowers debasement, spillages and tax evasion, among other money related deceitful exercises.”

Envision the situation of the serial marauders, fix suppliers and takers, usual to taking care of extraordinary measures of money.

Late reports, for instance, affirm that in 2011 an astounding $466m was pulled back in real money – crude notes and packages – to pay a couple of Nigerian government authorities to encourage Shell Petroleum’s obtaining of a lucrative oilfield. Shell said it didn’t trust its representatives acted wrongfully.

The CBN’s cashless arrangement would have made it hard for resulting influence takers to store such enormous entireties in banks.

Once more, the more distant family, followers and holders on can act the hero.

Individuals could open distinctive financial balances in the names of their kin, aunties and uncles, father, nephew, companions, in-laws, house young ladies, cooks, drivers et cetera.

The stacks of money can be broken into littler clumps and saved in these different records.

The records are opened in the names, which won’t have any knowledge or control over the exchanges.

Bank confirmation

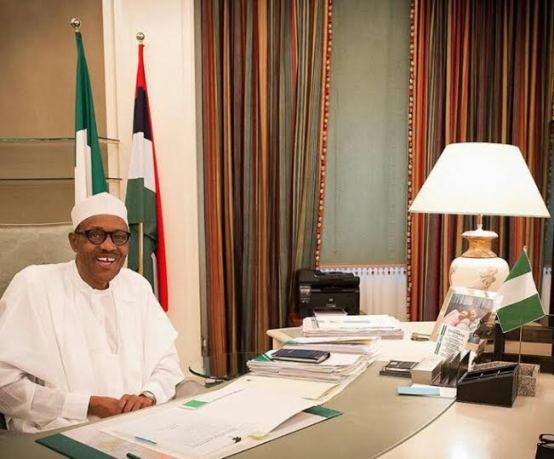

This short-circuiting of the cashless strategy appeared to work fine, until President Muhammadu Buhari came to control and presented yet another arrangement: The Bank Verification Number (BVN) approach.

Each bank client in Nigeria was required to have their biometric subtle elements caught and connected to a one of a kind number that could be confirmed over each record and exchange they made in each bank.

The initial step to getting a BVN was to turn up at the bank face to face.

As of November 2016, the Nigerian parliament was set to talk about the billions of neighbourhood and universal cash apparently surrendered in financial balances thus of the BVN approach.

Clearly, proprietors of questionable records are reluctant to venture forward and guarantee their wealth.

Banks in Nigeria are unquestionably no longer the best concealing spot for unexplained assets.

The $9.2m found in Mr Yakubu’s habitation was found in a flame resistant safe.

He has sued the EFCC for disregarding his crucial human rights, demanding that the cash was his – a “blessing from anonymous people”.

After much hypothesis as to its proprietorship, the $43.4m found in a Lagos loft was at long last guaranteed by the Nigerian Intelligence Agency (NIA), whose executive, Ayo Oke, expressed that the cash was discharged by the past government to help with the organization’s “unique administrations”.

Mr Buhari has suspended the executive from his position and requested a two-week test into the starting point of the assets.

Two years into his residency, President Buhari’s war on defilement is at long last delivering unmistakable outcomes – money – regardless of the possibility that there have been no prominent feelings yet.